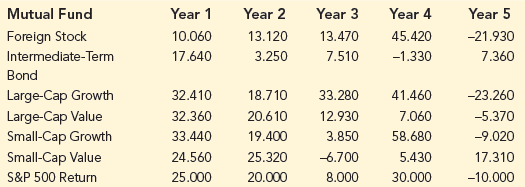

Let us consider again the investment data from Hauck Financial Services used in Section 14.4 to illustrate the Markowitz portfolio model. The data are shown below, along with the return of the S&P 500 Index. Hauck would like to create a portfolio using the funds listed, so that the resulting portfolio matches the return of the S&P 500 index as closely as possible.

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio’s return and the S&P 500 Index return for each year in the data set.)

b. Solve the model developed in part (a).