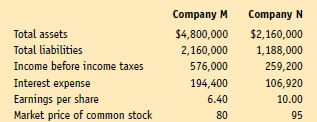

Long-term Solvency and Market Strength Ratios

An investor is considering investing in the long-term bonds and common stock of Companies M and N. Both firms operate in the same industry. Both also pay a dividend per share of $8 and have a yield of 10 percent on their long-term bonds. Other data for the two firms are as follows:

Compute the debt to equity, interest coverage, and price/earnings (P/E) ratios, as well as the dividends yield, and comment on the results. (Round computations to one decimal place.)

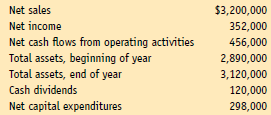

Cash Flow Adequacy Analysis

Using the data below from the financial statements of Braugh, Inc., compute the company’s cash flow yield, cash flows to sales, cash flows to assets, and free cash flow. (Round computations to one decimal place.)