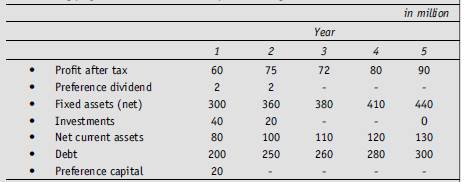

1.The following projections have been developed for Omega Limited

The cost of equity for Omega Limited is 16 percent. The FCFE will grow at a constant rate of 12 percent after 5 years, what is the value of Omega’s equity?

2. Vijay Limited has an invested capital of 100 million. Its return on invested capital (ROIC)

is 14 percent and its weighted average cost of capital (WACC) is 12 percent. The expected

growth rate in Vijay Limited’ revenues and invested capital will be 20 percent for the fi rst

four years, 12 percent for the following three years, and 10 percent thereafter forever.

(a) Calculate the enterprise DCF value of Vijay Limited

(b) Calculate the enterprise value of Vijay Limited using the economic profi t model.